does new hampshire charge sales tax on cars

Property taxes that vary by town. A 7 tax on phone services also exists in NH.

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

The Granite States low tax burden is a result of.

. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. However if a business has less than 92000 gross business income it does not have to file a return. There is no sales tax on anything in NH.

New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus. Answer 1 of 6.

You pay it every year and it declines to around 200 but thats it. Whilst tourists save money on shopping because of the 0 sales tax on goods purchased in stores they will pay more for the services above. Of the remaining states that charge sales tax on a car purchase 11 states charge approximately 4 percent or less.

Exemptions to the New Hampshire sales tax will vary by state. No inheritance or estate taxes. New Hampshires excise tax on gasoline ranks 31st out of 50 states.

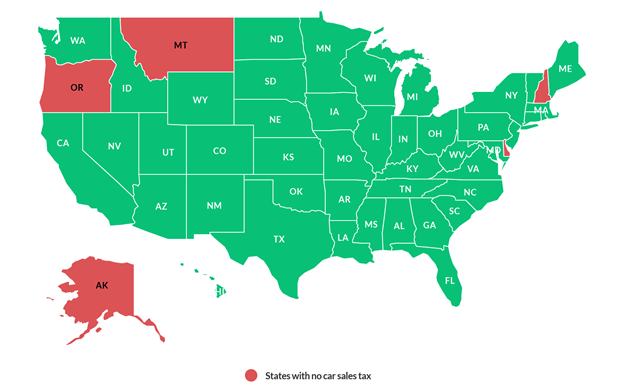

There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. These five states do not charge sales tax on cars that are registered there. New Hampshire does not have sales tax on vehicle purchases.

States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. Are there states with little to no sales tax on new cars. The tax is 76 percent for periods ending on or after December 31 2022.

New Hampshire Delaware Montana Oregon and Alaska. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055. The New Hampshire Sales Tax Handbook provides everything you need to understand the New Hampshire Sales Tax as a consumer or business owner including sales tax rates sales tax exemptions and more.

Knowing how much sales tax to pay when purchasing a vehicle also helps you to know when asking for financing from a lender. This is tax evasion and authorities are cracking down on. For more information on motor vehicle fees please contact the NH Department of Safety Division of Motor Vehicles 23 Hazen Drive.

You need to come back to NH get. Buy a car in Maryland North Carolina Iowa or. Nevada leads the group with an 825 percent sales tax rate.

However sales tax exemptions for vehicles arent necessary for New Hampshire since New Hampshire does not charge sales tax. New Hampshires excise tax on gasoline is 2220 per gallon less than 62 of the other 50 states. New Hampshire gas tax is included in the price at the pump at all gas stations in New Hampshire.

The 2022 Nissan Leaf starts under 28000 but prices soar to well over 100000 for an electric SUV pickup or high-performance luxury car. Alabama Colorado Hawaii Louisiana Missouri New Mexico New York North Carolina Oklahoma South Carolina and Virginia have the lowest rates among states that charge. What confuses people is the property tax on cars based upon their book value.

Dealers can only charge 27 on state document fees but theres no limit to the administrative fees they can charge. I did not pay any tax in MA. New Hampshire does collect.

Try our FREE income tax calculator. A 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7. TAX DAY NOW MAY 17th - There are -410 days left until taxes are due.

The New Hampshire cigarette tax of 178 is applied to every 20 cigarettes sold the size of an average pack of cigarettes. The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states. Some other states offer the opportunity to buy a vehicle without paying sales tax.

Washington DC the nations capital does not charge sales tax on cars either. 1145 and Arkansas 1125. Are there states with little to no sales tax on new cars.

As of 2020 while New Mexico charges sales tax on most goods it charges a. Documentation fees in dealerships in New Hampshire can vary. The average for New Hampshire doc fees was 304 in 2011 but it rose since then.

However sales tax exemptions for vehicles arent necessary for New Hampshire since New Hampshire does not charge sales tax. As of 2020 New York has a car tax rate of 4 plus local taxes whereas nearby Massachusetts charges 625 with some local rates even higher. The State of New Hampshire does not have an income tax on an individuals reported W-2 wages.

However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to buy a car to avoid paying sales tax. My neighbours who collect very expensive cars 1M do not. States with high tax rates tend to be.

The exchange does not affect sales tax in New Hampshire as there is no car sales tax. But you cannot drive back to NH once you buy. Most states in the US charge sales tax on cars.

What buyers rarely realize is that the sales tax can be a major expense. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. No capital gains tax.

Start filing your tax return now. Some dealerships charge up to 495 in documentation fees. Any entity doing business in New Hampshire must pay a business profits tax.

I live in NH I bought my car in Massachusetts as it was considerably cheaper than in NH for the car I was looking for.

00 Churchill Way Lebanon Nh 03766 Neren England Real Estate Virtual Tour Types Of Houses

A Complete Guide On Car Sales Tax By State Shift

Massachusetts Auto Sales Tax Everything You Need To Know

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

These States Have Suspended State Gas Tax Forbes Advisor

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

States With Highest And Lowest Sales Tax Rates

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Mean Elevation Of Each State In The U S Oc 2300x1500 Illustrated Map Map Usa Map

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Nj Car Sales Tax Everything You Need To Know

The Roche V4b Supercar Concept Super Cars Concept Cars Dream Cars

How Do State And Local Sales Taxes Work Tax Policy Center

Accounting Job Description Resume Cover Letter Skills Resume Advice Accounting Financial Analysis

Is Buying A Car Tax Deductible Lendingtree

Diamond Rv Center Photos Camping World Rv Sales Recreational Vehicles Camping World

Tax Burden By State 2022 State And Local Taxes Tax Foundation